India continues to move faster towards entering the prestigious top 10 positions in the Global startup facilitating nations by offering all support and necessary policy upgrades for the startups and budding entrepreneurs. The Indian startup ecosystem is rooting deep into the tier II and III towns and we witness a remarkable shift in the youth’s mindset towards getting onto the bandwagon. They are now switching onto a evolved mindset of raising a startup of their own after completing their college.

The government of India is taking all the right steps in the direction of making it possible for the youth to raise a startup, they are offered all kinds of help right from their college years, be it incubation centers in every city or innovation councils and mentors in every college. The government is constantly pushing them to work out their best to help the country prosper, with over 80 startups getting registered everyday, India now home of 93000+ startups with more and more unicorns.

The problems at hand: Early funding support

A startup needs funds from the very beginning to support their financial need and fulfil capital requirement, this early stage dept is riskier preposition for a commercial institution or a bank and they ask for credit history, and reputation which obviously a startup cannot produce and therefore the government came up with a solution to break this barrier of collateral as needed by most of the traditional funding institutions and banks.

A dedicated credit guarantee for startups recognized by DPIIT will address the issue of scarcity of collateral free loan and enable flow of financial assistance to innovative startups through their journey to becoming full-fledged business entities.

The Scheme marks the era of resilience by the Government ensuring its never out of focus attitude for promoting innovation and fostering entrepreneurship for making Indian startup ecosystem the best in the world.

This is a trigger towards a progressive change.

-Mr Narendra Modi

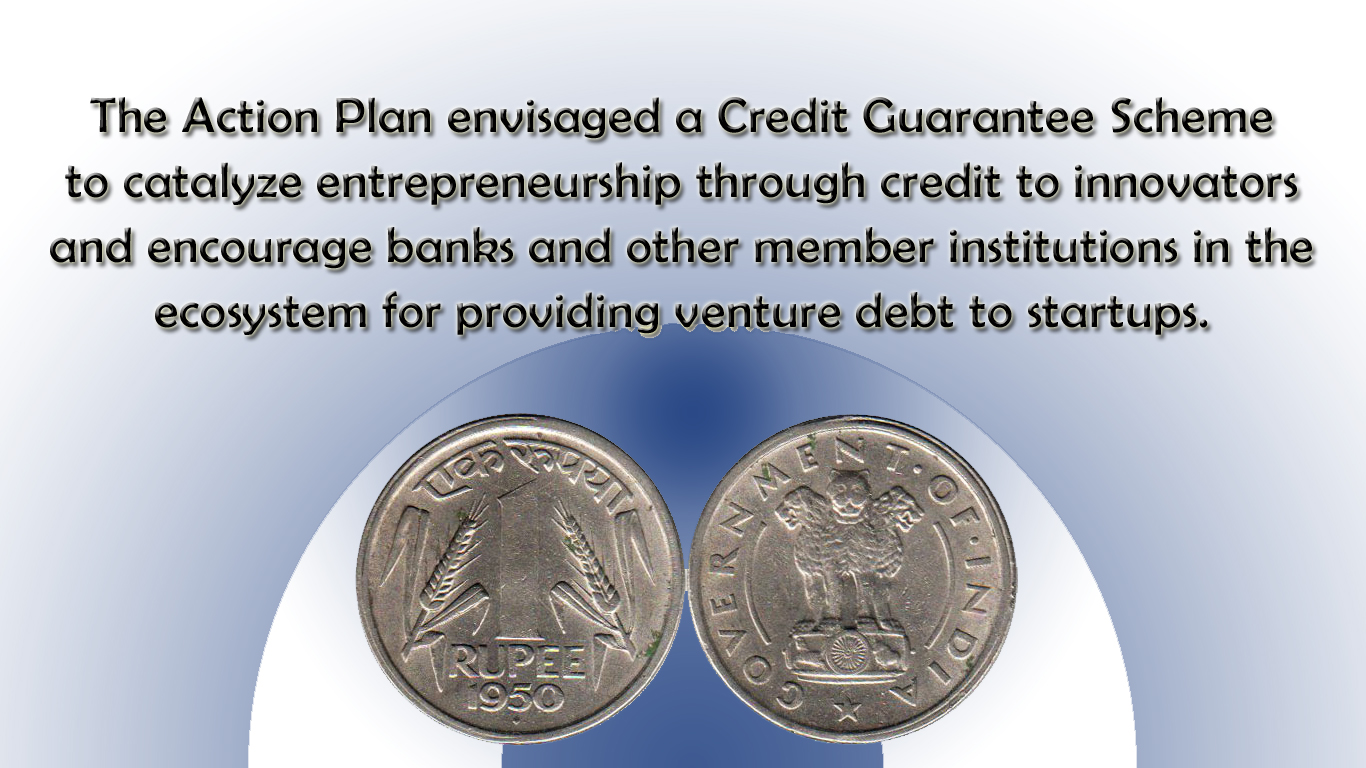

The Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry has notified in a press conference about this great news of establishment of the Credit Guarantee Scheme for Startups (CGSS) for providing credit guarantees to loans extended by Scheduled Commercial Banks, Non-Banking Financial Companies and Securities and Exchange Board of India (SEBI) registered Alternative Investment Funds (AIFs).

The establishment of CGSS is aimed at providing credit guarantee up to a specified limit against loans extended by Member Institutions (MIs) to finance eligible borrowers viz. Startups as defined in the Gazette Notification issued by DPIIT and amended from time to time. The credit guarantee cover under the Scheme would be transaction based and umbrella based. The exposure to individual cases would be capped at Rs. 10 crore per case or the actual outstanding credit amount, whichever is less.

Transaction based guarantee cover:

In respect of transaction-based guarantee cover, the guarantee cover is obtained by the MIs on single eligible borrower basis. Transaction based guarantees will promote lending by Banks/ NBFCs to eligible startups. The extent of transaction-based cover will be 80% of the amount in default if the original loan sanction amount is up to Rs. 3 crore, 75% of the amount in default if the original loan sanction amount is above Rs. 3 crore, and up to Rs. 5 crore, and 65% of the amount in default if the original loan sanction amount is above Rs. 5 crore (up to Rs. 10 crore per borrower).

Umbrella based guarantee cover:

The umbrella-based guarantee cover will provide guarantee to Venture Debt Funds (VDF) registered under AIF regulations of SEBI (a growing segment of funding in Indian startup ecosystem), in view of the nature of funds raised by them and debt funding provided by them. The extent of umbrella-based cover will be the actual losses or up to a maximum of 5% of Pooled Investment on which cover is being taken from the fund in eligible startups, whichever is lower, subject to a maximum of Rs.10 crore per borrower.

Along with institutional mechanisms for operationalizing the Scheme, DPIIT will be constituting a Management Committee (MC) and a Risk Evaluation Committee (REC) for reviewing, supervising and operational oversight of the Scheme. The National Credit Guarantee Trustee Company Limited (NCGTC) will be operating the Scheme.

Know if your startup is eligible for this scheme:

- Are you a DPIIT-recognized startup?

- You must not be in any default to any lending/investing institution and not be classified as Non-Performing Assets as per guidelines of the Reserve Bank of India (RBI)

- You have reached the stage of stable revenue stream, as assessed from audited monthly statements over a 12-month period.

The scheme is going to boost the startup ecosystem and ease business and raising funding. The guidelines and structure of the policy has been prepared after multiple deliberations by a panel of expert stakeholders from banks, NBFCs (Non-Banking Financial Companies), line ministries, Venture Debt Funds, startup founders, academicians and NGOS working in the field.

Polaris is running one of the best Incubation center in India imparting trainings and workshops on skillset enhancement to youth. Polaris work on startup ideas, the ideas those are innovative and can be developed into a real business. We work closely with young entrepreneurs while they are in their college and train them on entrepreneurship skills and motivate them to join the vision of new India with their own startups.

For more details on this policy please visit the government’s press release here.

Continue reading our latest blogs and subscribe to our newsletter.

Polaris Educational and Cultural Trust the parent body of Polaris Academy of Excellence and Polaris Incubation Center is running one of its kind Free SAT classes for USA college admissions in Graduation. Polaris Incubation Center is the best incubation center in Aligarh, working closely with small and regional colleges to provide them the best business incubator in Aligarh. Polaris Incubator, work on startup ideas, the ideas those are innovative and can be developed into a real business. Polaris Incubator, the first private Incubation center in Aligarh work closely with young entrepreneurs while they are in their college and train them on entrepreneurship skills and motivate them to join the vision of new India with their own startups. PAE Stack is employability and entrepreneurship development programs run by Polaris within the colleges as well as outside to make the youth of the region more employable and better placed for entrepreneurship ventures. For more details and information about the programs run by us for schools, colleges and communities please get in touch with us by subscribing to our newsletter.